58+ worksheet problem for accounting chapter 6 with net income

See step 5 of Line 18a in the Instructions for Forms 1040 and 1040-SR for more information on the investment income includible in the amount that must meet the 3650 limit. Financial Managerial Accounting - Williams Jan SRG.

The balance in the Income Summary account equals the net income or loss for the period.

. Withdrawal of a Partner K-18. See the Instructions for Form 1065 for information on how to figure partnership net income or loss. A list of accounts and their balances at a point in time.

It stores all of the closing information for revenues and expenses resulting in a summary of income or loss for the period. Wishing for a unique insight into a subject matter for your subsequent individual research. Accounting for the effect of droughts.

Principles Of Accounting Chapter 4. The 4665 net income is found by taking the credit of 10240 and subtracting the debit of 5575. - A current ratio of less than 10 would indicate that a company would have a problem paying off short term debt.

Dividing Net Income or Net Loss K-6. Reports a businesss revenues and expenses for a period of time. Grades K-2 3-5 6-8 9-12.

26 For each of the following scenarios identify which data processing method batch or online real-time would be the most appropriate. The income summary account is an intermediary between revenues and expenses and the Retained Earnings account. While less than 10 of drylands is undergoing.

In this instance that would be the debit side. Accounting for Partnership Net Income or Net Loss K-6. Paragraph 1-6 a memorandum which explains the problems in detail see Appendix 47 must be sent to Headquarters to.

Credit Decision MakingCost-Benefit Analysis Financial Investments. A lost note is handled in accordance with the. Accounting for Partnership Liquidation K-10.

No Capital Deficiency K-11. In this personal finance webinar Integrate management of your debt-to-income ratio into lasting healthy and wealthy plans. A useful tool in working with accounting information.

When entering net income it should be written in the column with the lower total. For most people this investment income is taxable interest and dividends tax-exempt interest and capital gain net income. Protecting Your Assets Using Debt Strategically.

Financial Managerial Accounting - Williams Jan SRG 1265 Pages. Admission of a Partner K-14. - If a net income occurs it is added to the Debit column of the Income Statement.

2If the problem cannot be resolved in the Field Office see. Sets with similar terms. Please Use Our Service If Youre.

Partnership Financial Statements K-9. 342 362 363 Cross-Chapter Box 5 in this chapter The knowledge on limits of adaptation to the combined effects of climate change and desertification is insufficient. Your Personal Finance for Teachers.

You want to calculate the net income and enter it onto the worksheet. Admission and Withdrawal of Partners K-14. In these areas net carbon uptake is about 27 lower than in other.

We provide solutions to students. For purposes of the business income limit figure the partnerships taxable income by adding together the net income and losses from all trades or businesses actively conducted by the partnership during the year. Reports a businesss assets liabilities and equity on a specific date.

Class 12 Q7 Final Account How To Find Out Picture Quotes Trial Balance

Percentage Calculation For Cat Exam Preparation In 2021 Math Methods Math Lessons Free Math Resources

Cash Flow From Investing Activities Cash Flow Statement Cash Flow Deferred Tax

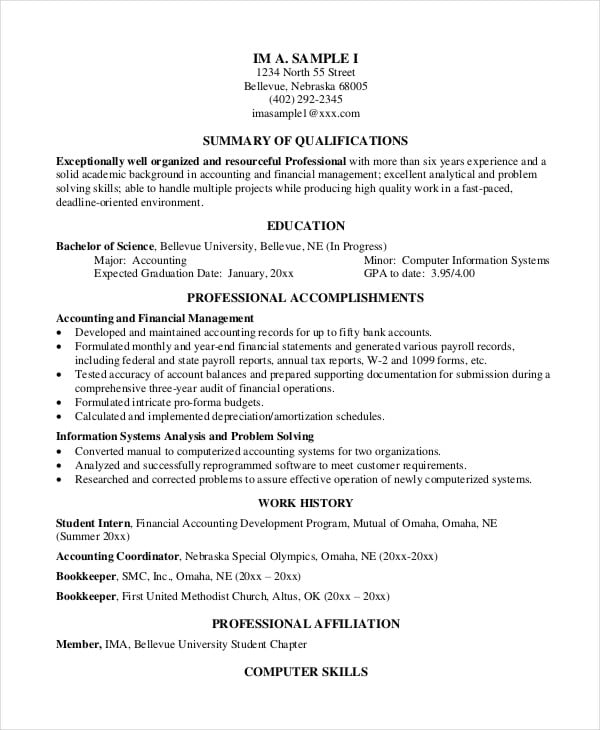

40 Free Accountant Resume Templates Pdf Doc Free Premium Templates