Federal withholding calculator paycheck

Sign Up Today And Join The Team. 250 minus 200 50.

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Ad Payroll So Easy You Can Set It Up Run It Yourself.

. For employees withholding is the amount of federal income tax withheld from your paycheck. Federal Income Tax Withheld. 250 and subtract the refund adjust amount from that.

Subject to Withholding twage tnraW4form. The calculation for FICA withholding is fairly straightforward. After you enter the dollar amounts and click calculate a table will appear that provides you with the marital status and number of allowances exemptions the amount of federal taxes.

Get Your Quote Today with SurePayroll. This module calculates Paycheck withholding either from GROSS pay to NET pay or NET pay to GROSS pay. For example if an.

How to calculate annual income. The result is net income. Each pay period open each employees Tax Withholding Assistant spreadsheet and enter the wage.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Get Fast Easy and 100 Accurate Way and Tools to File Taxes. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

The amount of income you earn. Get Started Today with 2 Months Free. Over 900000 Businesses Utilize Our Fast Easy Payroll.

Free Unbiased Reviews Top Picks. Free salary hourly and more paycheck calculators. Sign Up Today And Join The Team.

Collect required documents Gathering all relevant documents from your employees is the first step in correctly. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Learn About Payroll Tax Systems.

Once you have worked out your tax liability you minus the money you put aside for tax withholdings every year if there is any. Lets call this the refund based adjust amount. Over 900000 Businesses Utilize Our Fast Easy Payroll.

This number is the gross pay per pay period. Tax Withholding Estimator. All Services Backed by Tax Guarantee.

Estimate your paycheck withholding with our free W-4 Withholding Calculator. Search for Calculate fed tax withholding. This is tax withholding.

IR-2019-178 Get Ready for Taxes. Get ready today to file 2019 federal income tax returns. IR-2019- 107 IRS continues campaign to encourage taxpayers to do a.

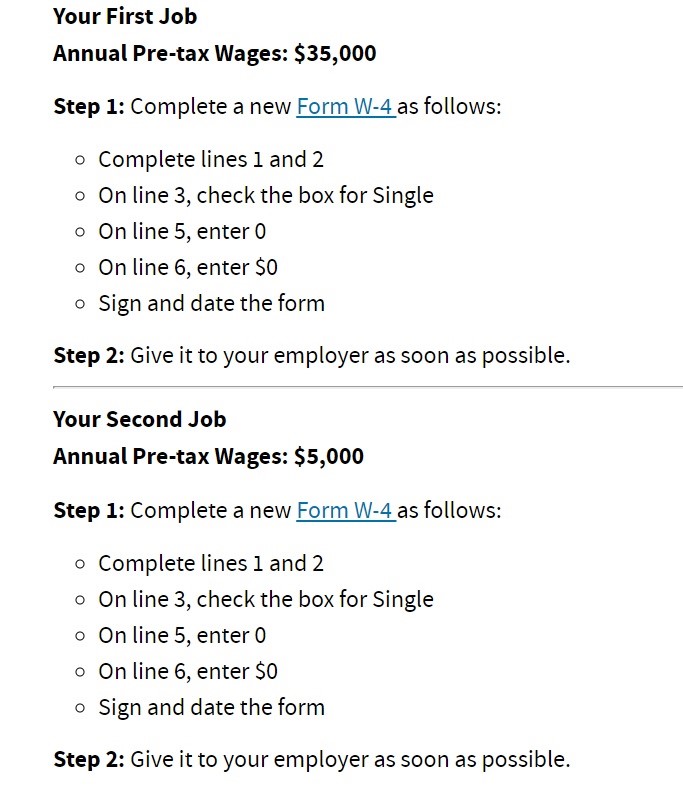

9 Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate.

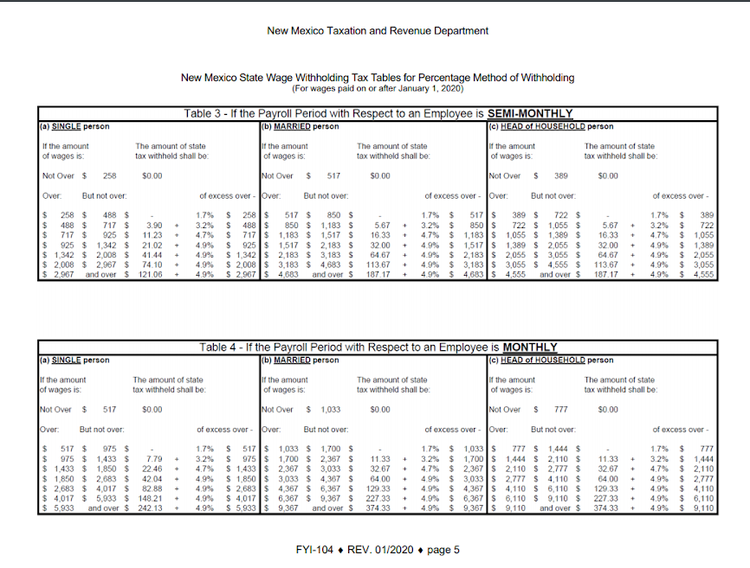

Determine the value of your total withholding allowances exemptions as claimed on your current Form W-4 by multiplying each by the semi-monthly amount of 16880Subtract the. Ttaxdefamt tallowance. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck.

Total annual income Tax liability. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. Ad Compare This Years Top 5 Free Payroll Software.

The calculations include federal state and local withholding as well. The withholding calculator can help you figure the right amount of withholdings. Follow the steps below to calculate federal withholding tax rate.

Ttgw bracket tisw. Then look at your last paychecks tax withholding amount eg. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand.

Learn About Payroll Tax Systems. Subtract any deductions and. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

Save a copy of the spreadsheet with the employees name in the file name. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

Free Paycheck Icalculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Amazon Com Appstore For Android

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp Payroll Payroll Software Payroll Taxes

Paycheck Calculator Online For Per Pay Period Create W 4

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate Payroll Taxes For Your Small Business

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Paycheck Taxes Federal State Local Withholding H R Block

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Calculation Of Federal Employment Taxes Payroll Services

Free Online Paycheck Calculator Calculate Take Home Pay 2022

How To Calculate Payroll Taxes Methods Examples More

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Paycheck Tax Withholding Calculator For W 4 Tax Planning

California Paycheck Calculator Smartasset